Dealing with Cash PaymentsA common problem for businesses who receive payments in cash, cheques and credit cards and then pay suppliers with the cash received is how to balance the bank deposits, especially when integrating with a General Ledger. For example, you have receipts of $1,200 in a combination of cash and cheques and pay a bill for $100 in cash. Therefore $1,100 is deposited. Or some cash is kept in the till, some is used to make petty cash purchases and some is banked. The procedure to deal with this is as follows: Create Bank AccountsIn real life, you have a cheque account and cash in the till. In your General Ledger you have an account which represents cash on hand and an account which represents the cheque account. In Cadzow 2000 you need an account for cash and an account for the cheque account. These three layers relate to each other directly: - Cash in till ↔ General Ledger cash on hand ↔ Cadzow 2000 “bank account” (cash)

- Cash in cheque account ↔ General Ledger cash at bank ↔ Cadzow 2000 “bank account” (cheque account)

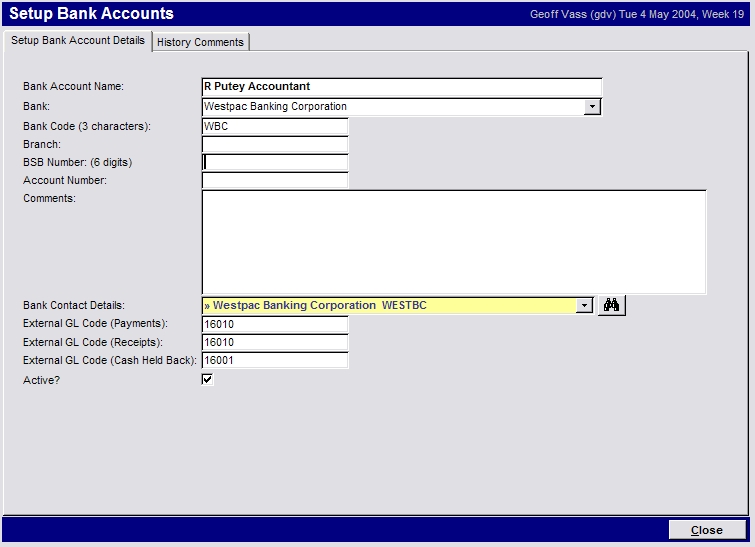

The Cadzow 2000 bank accounts are set up under Accounts Receivable, Banking, Set Up Bank Accounts. (If your circumstances are complex enough, you could maintain several cheque/savings accounts and several cash on hand accounts.) If integrating with a General Ledger, complete the External GL Code (Payments), External GL Code (Receipts) and External GL Code (Cash Held Back) fields:  - For the cheque/deposit account, the code specified for payments and receipts are usually the same and represent the asset account in the balance sheet for that account. Cash Held Back is the cash on hand account; and

- For the cash account, the payments, receipts and cash held back items are all the cash on hand account.

Hold Cash Back from BankingThe cheques and cash etc to be deposited are selected under Accounts Receivable, Banking, Current Banking. Select all cheque entries to be banked and select all cash entries. The total cash is shown by Cash Selected. Enter a value next to Cash Held Back so that Cash to Deposit matches the exact value to be banked. At this stage you do not need to make any allowance for what happened to the cash being held back; perhaps it was kept in the till or used for petty cash or used to pay an expense, it doesn't matter. Enter Cash PurchasesIf some cash has been used to pay expenses or for petty cash, these purchases must be entered in the normal way. Petty cash expenses are best entered using Accounts Payable, Express Purchases (which enables a purchase and payment to be entered in one operation). If paying a bill, simply enter the payment as per normal. However, instead of making the payment against the default bank account, change the Bank Account to the "Cash" account. Cash Kept in the TillCash kept in the till requires no further action. Effect on General LedgerPayments and receipts are transferred to the designated General Ledger account codes. In the case of deposits with cash held back, the value of cash held back is debited to cash on hand and the remainder is debited to the bank account. Thus the total value of receipts is debited to the balance sheet (with a corresponding credit to the debtors control account) and there is an easily reconciled deposit value against the bank account. When making a payment against the "Cash" bank account, those entries are transferred to the cash on hand account specified. As debits are posted to cash on hand via cash held back, and credits are posted via payments made from the cash bank account, the value of cash on hand in the balance sheet will rise and fall. If this system is maintained properly the cash on hand in the balance sheet should exactly match the cash in the till. Tip: If you are adding cash to the banking that was previously held back, you can enter a negative Cash Held Back value. This simply adds to the deposit and takes cash from the till and puts it in the bank. |